kern county property tax rate

The median property tax on a 21710000 house is 173680 in Kern County. Single Family Residence on R-1 Zoned Land.

Kern County Property Tax Fill Online Printable Fillable Blank Pdffiller

Kern County Tax Payer.

. Change a Mailing Address. How much does Kern County CA pay. The median property tax also known as real estate tax in Kern County is 174600 per year based on a median home value of 21710000 and a median effective property tax rate of 080 of property value.

Information in all areas for Property Taxes. To avoid a 10 late penalty property tax payments must be submitted or postmarked on or before Dec. Property 6 days ago People also ask.

561-562 Assessed Valuation of Schools and Other Special Districts. Request a Value Review. File an Assessment Appeal.

What is the sales tax rate in Kern County. Cookies need to be enabled to alert you of status changes on this website. So for example if your home is deemed to be worth 200000 and your local tax rate is 15 your property.

Tax bills were mailed to all property owners whose addresses were on file with the county assessor as of Jan. The Assessor values all taxable property in the County. 10 a press release from Kern County.

This convenient service uses the latest technology to provide a secure way to bid on tax defaulted property. Kern County Property Tax Information. The assessment roll is prepared by the Assessor.

A valuable alternative data source to the Kern County CA Property Assessor. For a list of your current and historical rates go to the California City County Sales Use Tax Rates webpage. Please enable cookies for this site.

The California state sales tax rate is currently. Stay Connected with Kern County. Tax Rate Areas Kern County 2022.

This is the total of state and county sales tax rates. The minimum combined 2020 sales tax rate for Kern County California is 725. Look up the current sales and use tax rate by address.

The Kern County sales tax rate is. Get free info about property tax appraised values tax exemptions and more. Find Property Assessment Data Maps.

Please select your browser below to view instructions. The property tax rate in the county is 078. The minimum combined 2022 sales tax rate for Kern County California is.

If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Kern County Tax Appraisers office. The average Kern County CA monthly salary ranges from approximately 2703 per month for Office Technician to 8543 per month for Lieutenant. Search for Recorded Documents or Maps.

The median property tax on a 21710000 house is 160654 in California. Government Offices 661 868-3407. 2001-2002 Annual Property Tax Rate Book.

Service charge by parcel. Total Assessed Valuation of Kern County. Tax rate set by County Irrigation District Bonds and Debt.

DeedAuction is part of our offices. See reviews photos directions phone numbers and more for Kern County Property Taxes locations in Oildale CA. 1 be equal and uniform 2 be based on current market worth 3 have one estimated value and 4 be considered taxable if its not specially exempted.

Find All The Assessment Information You Need Here. This is the total of state and county sales tax rates. Welcome to the Kern County online tax sale auction website.

Taxation of real property must. Within those confines the city sets tax rates. The 2018 United States Supreme Court decision in South Dakota v.

1115 Truxtun Avenue Bakersfield CA 93301-4639. City level tax rates in this county apply to assessed value which is equal to the sales price of recently purchased homes. In Kern County the average property tax rate is 08 making property taxes slightly higher than the state average.

California City County Sales Use Tax Rates effective April 1 2022 These rates may be outdated. Purchase a Birth Death or Marriage Certificate. How much does Kern County CA pay.

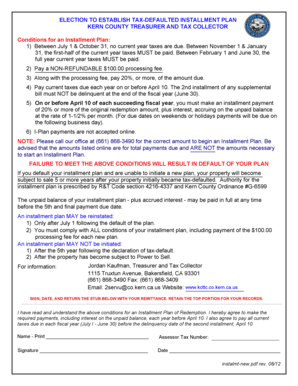

Appropriate notice of any levy increase is another requisite. The first installment of Kern County property taxes is due by 5 pm. Ad Unsure Of The Value Of Your Property.

With easy access to tax sale information and auction results you can research properties and enter bids from anywhere in the world. A tax rate area TRA is a geographic area within the jurisdiction of a unique combination of cities schools and revenue districts that utilize the regular city or county. File an Exemption or Exclusion.

Auditor - Controller - County Clerk. Of course exact tax rates vary based on. This means that residents can expect to pay about 1746 annually in property taxes.

Get Information on Supplemental Assessments. Total tax rate Property tax.

San Francisco County Ca Property Tax Search And Records Propertyshark

Kern County Treasurer Secured Property Tax Bills Mailed Kern Valley Sun

Kern County Treasurer And Tax Collector

Kern County Treasurer And Tax Collector

Kern County Treasurer And Tax Collector

Kern County Treasurer And Tax Collector

Kern County Treasurer And Tax Collector

Kern County Treasurer And Tax Collector

Kern County Treasurer And Tax Collector